The analytics company was founded in 1956 by an engineer, Bill Fair, and a mathematician, Earl Isaac. Each one creates and sells credit scores to lenders and other businesses in the financial industry.įICO is a publicly traded company based in California. FoundersįICO and VantageScore Solutions are two competing companies. Below are a few key differences between the two credit score brands. You can think of them like the Pepsi and Coca Cola of the financial world. Differences Between FICO Scores and VantageScoreĭespite the fact that FICO Scores and VantageScores serve a similar purpose, they aren’t identical. So, FICO and VantageScore Solutions have to prove that each credit scoring model they build does what it’s designed to do. And they have to work (aka demonstrably and statistically sound).Ī credit score is supposed to predict the likelihood that someone will pay a bill 90 or more days late in the upcoming 24 months. need to be built using a proven, scientific method (aka empirically derived). Those terms mean that credit scores in the U.S. must be empirically derived, demonstrably and statistically sound. The ECOA states that credit scores used for lending purposes in the U.S. Specifically, it has to satisfy a federal law known as the Equal Credit Opportunity Act (ECOA). ECOA Complianceīefore a lender can use a credit score to evaluate applicants, the scoring model must pass a few tests. This fact is true whether those numbers are calculated by a FICO or a VantageScore credit scoring model. Information outside of your credit reports has no direct impact on your scores. These details include information like your payment history, credit utilization ratio, the age of your accounts, mixture of account types and more.Īll of the factors which cause your credit score to move up or down are found on your credit reports. Your credit scores, regardless of the brand, are influenced by similar factors. A lower credit score signals the opposite. When you have a higher credit score it means you’re less likely to pay your bills severely late (90 days or more after the due date) in the near future (the next 24 months). They can predict the likelihood that a consumer will pay any credit obligation 90 days late or worse within the two years. Both FICO and VantageScore credit scores share the same stated design objective. This job is known as the scoring model’s stated design objective.

Design ObjectiveĬredit score creators design their scoring models to do a specific job. In fact, the lifetime value of a good credit score could save you tens or even hundreds of thousands of dollars. Higher scores make it easier to qualify for financing and to receive competitive financing offers from lenders. With both FICO and VantageScore models, higher scores are better.

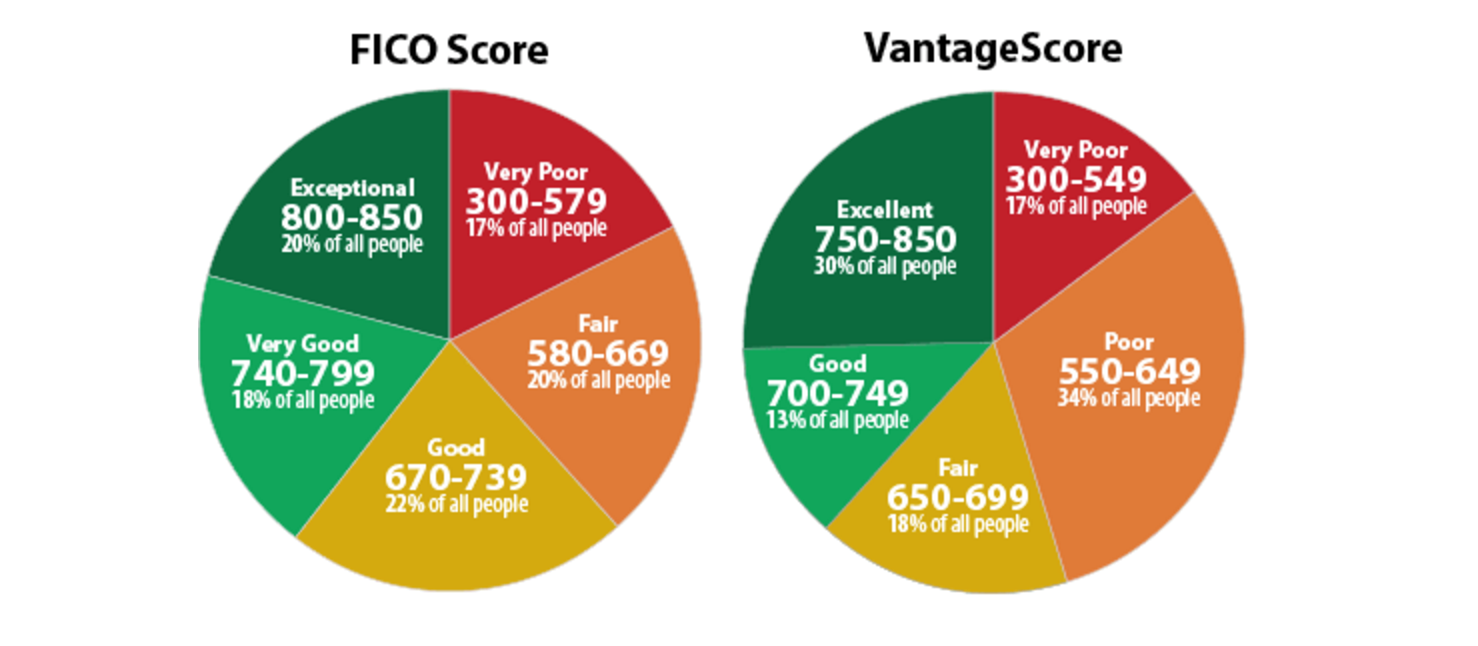

However, VantageScore 3.0 and 4.0 adopted the same 300 to 850 scale that FICO uses. At first, VantageScore credit scores featured a different numerical scale (501 to 990).

Credit Score RangeįICO Scores range from 300 to 850.

Since both FICO and VantageScore credit scores serve this same purpose, it shouldn’t be surprising that they share a number of features. It can help lenders judge whether loaning you money is a wise investment. Similarities Between FICO Scores and VantageScoreĪ credit score is a snapshot evaluation of your credit risk at a given point in time.

0 kommentar(er)

0 kommentar(er)